Why Is GSTR-2 Suspended? Everything You Need to Know, Get Practical GST Course in Delhi, 110003, by SLA Consultants India, New Delhi

Jul 1st, 2025 at 12:27 Directory Delhi 121 views Reference: 29Location: Delhi

Price: Contact us Negotiable

Why Is GSTR-2 Suspended? Everything You Need to Know

GSTR-2 was introduced as part of India’s Goods and Services Tax (GST) regime to enable taxpayers to report inward supplies (purchases) and reconcile their Input Tax Credit (ITC) with the details submitted by their suppliers in GSTR-1. However, the government suspended GSTR-2’s implementation in September 2017, and it remains on hold as of 2025.

Key Reasons for GSTR-2 Suspension

-

Complexity of Filing: GSTR-2 required businesses to manually match each purchase invoice with the supplier’s sales data, making the process highly cumbersome and error-prone, especially for small and medium enterprises (SMEs).

-

Technical Challenges: The GST Network (GSTN) faced significant technical issues and lacked the capacity to handle the volume and complexity of data reconciliation required for GSTR-2.

-

Compliance Burden: Frequent changes in GST rules and the intricate nature of GSTR-2 created confusion and compliance difficulties for businesses, leading to widespread delays and errors.

-

Transition to Simpler Returns: Recognizing these challenges, the government decided to indefinitely suspend GSTR-2 and instead introduced auto-generated statements—GSTR-2A (dynamic, real-time) and GSTR-2B (static, monthly)—to help businesses verify and reconcile ITC without manual filing.

Implications for Businesses

-

Simplified Compliance: The suspension of GSTR-2 has reduced the compliance burden, particularly for SMEs, by eliminating the need for manual invoice matching and complex reconciliations.

-

ITC Verification: Businesses now rely on GSTR-2A and GSTR-2B, which auto-populate purchase data from supplier filings, making ITC claims easier and reducing the risk of mismatches.

-

No Official Reintroduction: There is currently no indication that GSTR-2 will be reintroduced in its original form. The government is expected to focus on further simplifying GST compliance and leveraging technology for automation.

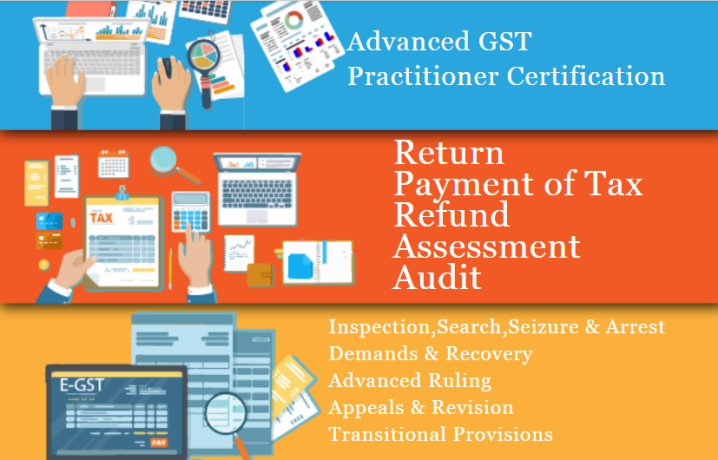

Get Practical GST Course in Delhi, 110003, by SLA Consultants India, New Delhi

For professionals, accountants, and business owners seeking to master GST compliance—including return filing, ITC reconciliation, and the latest GST updates—SLA Consultants India, New Delhi offers a comprehensive, practical GST Certification Course in Delhi.

Key Features of the GST Course:

-

Expert-Led Training: Sessions conducted by experienced Chartered Accountants and GST practitioners.

-

Hands-On Practical Learning: Real-world case studies, live return filing practice, and reconciliation techniques using GSTR-1, GSTR-2A/2B, and GSTR-3B.

-

Updated Curriculum: Covers all recent amendments, e-invoicing, and compliance strategies relevant to current GST law.

-

Industry-Oriented Modules: Includes GST, Income Tax/TDS, financial statement finalization, and banking/finance instruments.

-

Flexible Learning: Options for classroom and online learning at their New Delhi center (110003).

This course is ideal for those wishing to stay compliant, improve their GST skills, or pursue a career in taxation and accounting.

For enrollment details, visit the official SLA Consultants India website or contact their New Delhi center for the latest offers and batch schedules.

In summary:

GSTR-2 was suspended due to its complexity, technical challenges, and compliance burden. Businesses now use GSTR-2A and GSTR-2B for ITC reconciliation. For practical, up-to-date GST training in Delhi (110003), SLA Consultants India offers specialized courses to help you navigate the evolving GST landscape134.

SLA Consultants Why Is GSTR-2 Suspended? Everything You Need to Know, Get Practical GST Course in Delhi, 110003, by SLA Consultants India, New Delhi Details with "New Year Offer 2025" with Free SAP FICO Certification are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

GST Training Courses

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/