Understanding GSTR-1, GSTR-2, and GSTR-3B: A Complete Guide, Get Practical GST Course in Delhi, 110031, by SLA Consultants India, New Delhi

Jun 24th, 2025 at 12:17 Directory Delhi 127 views Reference: 28Location: Delhi

Price: Contact us Negotiable

Understanding GSTR-1, GSTR-2, and GSTR-3B: A Complete Guide

GSTR-1, GSTR-2, and GSTR-3B are key GST returns in India, each serving a distinct compliance purpose. Here’s a concise guide to their functions, differences, and practical learning opportunities in Delhi with SLA Consultants India.

GSTR-1: Outward Supplies Return

-

GSTR-1 is a monthly or quarterly return that captures details of all outward supplies (sales) made by a business.

-

Every registered taxpayer, except those under special schemes like the Composition Scheme, must file GSTR-1.

-

It includes invoice-wise details of sales, debit/credit notes, and is crucial for passing input tax credit to buyers.

-

Filing GSTR-1 accurately ensures that your buyers can claim the correct input tax credit and helps maintain compliance.

GSTR-2: Inward Supplies Return (Currently Suspended)

-

GSTR-2 was originally designed to capture details of inward supplies (purchases) for a business.

-

It would allow taxpayers to claim input tax credit based on their purchases.

-

However, due to technical and practical challenges, GSTR-2 filing has been suspended by the government. Presently, businesses do not file GSTR-2, but should still maintain purchase records for reconciliation and compliance.

GSTR-3B: Monthly Summary Return

-

GSTR-3B is a simplified monthly self-declaration summarizing outward supplies, input tax credit claimed, and net tax payable.

-

It is mandatory for all regular taxpayers and must be filed even if there are no transactions in a period.

-

GSTR-3B must be submitted before GSTR-1 for the same period, and timely filing is essential to avoid penalties and interest.

-

The GST portal provides tools to reconcile GSTR-1 and GSTR-3B, ensuring accuracy and consistency in tax reporting.

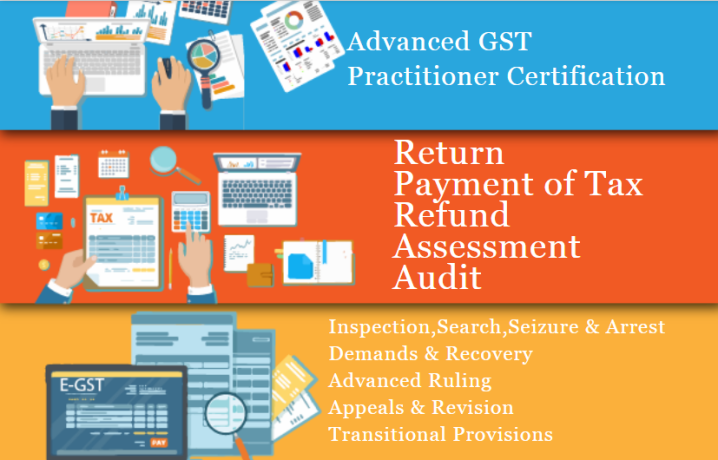

SLA Consultants India, based in New Delhi, offers a comprehensive Practical GST Course in Delhi. The training is ideal for accountants, business owners, and tax professionals seeking hands-on expertise in GST compliance, including detailed modules on GSTR-1, GSTR-2, and GSTR-3B.

Course Highlights:

-

Practical exposure to GST compliance, return filing, and troubleshooting.

-

Real-world case studies and reconciliation exercises (especially for GSTR-1 and GSTR-3B).

-

Guidance on handling GST scrutiny notices, ITC claims, and tax payment strategies.

-

Training by experienced Chartered Accountants with up-to-date industry insights.

-

Suitable for professionals aiming to master GST returns and avoid penalties.

Summary:

GSTR-1 reports sales, GSTR-2 (currently suspended) was meant for purchases, and GSTR-3B is a monthly summary for tax payment. SLA Consultants India’s practical GST course in Delhi equips professionals with the skills to manage these returns effectively, ensuring compliance and confidence in GST operations.

SLA Consultants Understanding GSTR-1, GSTR-2, and GSTR-3B: A Complete Guide, Get Practical GST Course in Delhi, 110031, by SLA Consultants India, New Delhi Details with "New Year Offer 2025" with Free SAP FICO Certification are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

GST Training Courses

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/